Want to stay caught up in all things agriculture? Sign up for the newsletter and get all the latest news straight to your inbox.

Four Tips for Farmers to Set Themselves Up for Financial Success in 2025

By: Logan Spalding

As the new year kicks off, it’s a good time to look ahead and what you can do to set yourself up for success. While 2024 was a rough year for many reasons - from increased supply prices to weather disruptions and low commodity prices – now is a good time to put that behind you and do a little planning to increase your chances of success in 2025. Here are a few things you can do to get 2025 off to a good start:

Review Your Agronomic and Economic Plans

There’s never a bad time to review your agronomic and economic plans, but the beginning of a new year provides a great opportunity to sit down with pen and paper – or better yet by leveraging technology like Nutrien’s HUB - to make sure you’re headed in the right direction. Make sure you understand your cash flow, your liabilities and your breakeven point. If your payment deadlines don’t meet up with your revenue cycles, think about how you’ll manage those due dates.

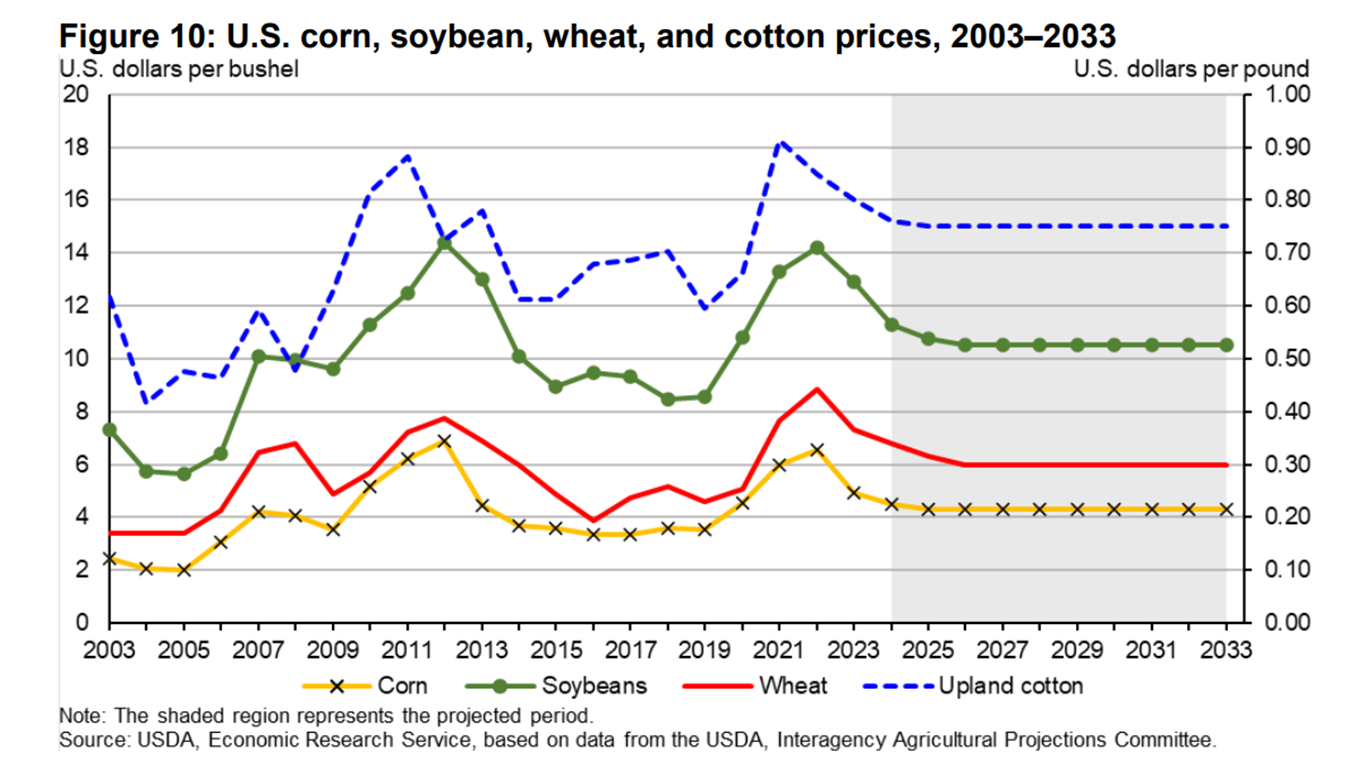

Despite the prevailing sentiment that farming is currently facing tough times with low commodity prices, it's important to remember that projections have been wrong before and we are feeling some market relief in certain areas. While margins are undeniably tight, we must focus on what we can control and stay diligent. Commodity prices can be unpredictable and may surprise us from one month to the next. So, don't let the headline news bring you down—your reality might be very different.

To help manage through another tight season, it’s important to know the big picture view of your expenses and revenue expectations, and having that understanding is crucial for maximizing every opportunity available for profitability in 2025. While many growers are aware of their breakeven point, simply breaking even isn't cause for celebration; adopting a business manager's mindset and aiming for profitability can help set a more ambitious and strategic framework for success.

Nutrien Financial can help you pair your goals with the right mix of inputs and financing options. The Nutrien HUB can even help you view current rates, terms and incentives so you get an overall view of your input costs. You can work with your crop advisor to also ensure you’re doing everything you can to maximize your yield, while at the same time minimizing interest expense

Assess Your Capital Management Strategies

As part of your review of your agronomic plans, it’s important to really understand your capital management strategies. What are your costs going into the new year and specifically your crop seasons? And how do you pay for those costs? Having a blended strategy of cash, prepay and various financing options can be a good approach for many growers.

Part of good capital management is making sure you keep your credit in good shape. Avoid late fees, make sure you don’t default on payments and try not to max out your credit lines. One way to automate some of this is to schedule payments ahead of time. Nutrien’s HUB allows you to schedule payments so you never miss one, which also helps keep your credit intact.

Preserving your bank line of credit can be a good idea, and finding alternative forms of financing some of your costs can help you keep that operating line clear. Work with trusted experts to make sure you’re considering all of the costs of financing, including not only interest rates, but factoring in valuable terms and conditions that can align with the seasonality of your harvest cycle. When margins are tight like they were in 2024, seemingly small things like payment due dates can make a big difference to your bottom line.

Prepare for the Unknown

Preserving cash and your operating line can be important strategies to combat unexpected hurdles. We can’t control the weather or commodity prices, and there’s still a lot of uncertainty in the market overall, but if you prioritize having some cash on-hand, you’ll be better equipped to weather any ups and downs.

Another element to factor in is that interest rates are likely to remain high when compared to recent history and will continue to be a considerable expense for growers already grappling with profitability issues. We also don’t yet know how labor costs and availability of labor may change, which can make a big impact on many growing operations. The best way to be ready for unplanned costs is to have various financial options to fall back on.

It's important to focus on careful credit management and take proactive steps to ensure you have access to credit when you need it most, especially during challenging times. Securing lines of credit before they become necessary can provide peace of mind.

Stay Optimistic About the Future

It’s been hard for growers to make a profit in the last year, so there may not be a lot of optimism going into 2025. It may feel like a lot of doom and gloom, but there’s still much to be optimistic about. For most of us, farming is a way of life that we truly love. Farm roots run deep and if we look backward, we can see the industry has successfully weathered many storms in the past. Growers are some of the most resilient and committed people out there, and I’m personally optimistic about the future and the opportunities this year presents.

Take the time now to review your financial plan, consider your capital management strategies and prepare for the unexpected, and you should be set to make the most out of 2025.